Annuities

An annuity is a long-term retirement savings product that can help protect you from outliving your money. It has the potential to grow tax-deferred, have death benefits to protect your beneficiary and optional living benefits to protect your retirement income. You can choose how to fund your annuity, how interest is credited to it and how you take payments from it.

Keep More Of Your Retirement Money

Tax-Deferred Fixed Annuities help you to keep more of what you’ve earned.

Guaranteed Safety

There is no reason to risk your retirement money because traditional fixed and fixed index annuities guarantee you that you will never lose any of your principal deposit or interest credited to your account.

Tax-Deferred Accumulation

Annuities are not subject to Federal income taxes until you make withdrawals. This allows your money to grow faster than it would if it were in a plan taxed annually. This gives you triple compound interest: interest on your principal, interest on the interest earned, and money saved by not having to pay taxes annually on earned interest.

Competitive Interest Rates

Traditional fixed annuities offer competitive interest rates and fixed index annuities combine safety (you never lose interest credited to your account) with potential upside stock market gains. (subject to a cap on the interest credited).

Income Riders

For a small fee, which is usually less than 1%, you can add an Income Rider to the Base Annuity contract. This is a great option for someone who wants their money to grow for a few years, followed by receiving income. It guarantees you an interest rate of 6-7% or more annually.

What can an Annuity do for you?

- An Annuity can guarantee a steady stream of future income in exchange for a single premium payment or a series of premium payments.

- As a long-term financial vehicle that grows tax-deferred during the accumulation phase, annuities can help safeguard against the risk of an individual outliving his or her assets by providing periodic income payments that can be guaranteed for life.

- You may want to leave a legacy, with an annuity you can provide your loved ones with a death benefit in the event of your death.

Fixed Annuities can offer tax-deferred growth, options for guaranteed income benefits and flexible access to funds, should your plans and needs change.

Why should you consider an Annuity?

Annuities can help you generate retirement income. That’s important because planning for retirement invariably comes down to one simple question: Will you have enough money to last the rest of your life?

Pursue upside potential without sacrificing security. With fixed indexed annuities, the interest rate on a portion of your premium is tied, in part, to a published stock market index, giving you the opportunity to benefit from market trends without owning stocks. Your principal is protected from loss due to market downturns.

Protect and grow your savings. Multi-year guaranteed annuities provide you with tax-deferred growth at a fixed rate of interest for a period of time spelled out in the annuity contract. They also offer, the opportunity to produce a guaranteed stream of retirement income you cannot outlive.

Single premium immediate annuities make retirement planning easier because they’re predictable. In exchange for a lump sum of money (Single Premium), a SPIA pays a guaranteed amount for a specified time period or until you or your spouse dies.

Fixed Annuities may also include or offer optional riders that can be purchased for a charge. Rider features vary by product and can offer benefits like lifetime income, increased liquidity or a death benefit option.

A deferred annuity is characterized by an accumulation period, funded through either periodic premium payments or by a single lump sum payment. The assets accumulate tax-deferred and annuity payments are put off until a later date, at which time a payout option is selected. An immediate annuity is purchased with a single payment and is designed to generate an immediate stream of income.

Annuities can be used to help you increase your saving, protect what you’ve saved or generate a stream of income. Annuities generally fall into two categories: Deferred and Income. Each works differently and offers unique advantages.

Deferred annuities can be a good way to boost your retirement savings. Life any tax-deferred investment, earnings compound over time, providing growth opportunities that taxable accounts lack. Bear in mind that withdrawals of taxable amounts from an annuity are subject to ordinary income tax, and, if taken before age 59 ½, may be subject to a 10% IRS penalty.

Income annuities may be appropriate for investors in or near retirement because they offer guaranteed income for life of a set period of time. They may allow you to be more aggressive with other investments in your portfolio, since they provide a lifetime income stream.

Traditional fixed and fixed index annuities can be a great retirement vehicle for people who want to keep more of what they earn.

Additional Benefits Of Fixed Annuities:

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Pariatur, aspernatur, velit. Adipisci, animi, molestiae, neque voluptatum non voluptas atque aperiam.

Access To Your Money

There are a variety of ways to taking money out of your Annuity, including annual 10% or more free withdrawals and retirement income.

Bonus Payment And Avoidance Of Probate

Some Annuity contracts give you a 5%- 12% or more bonus on your deposit(s). Proceeds can also pass directly to your beneficiaries without the delays and the cost of probate.

Income for Life

Other than Social Security, an Annuity contract is the only other way you are guaranteed lifetime income.

No Sales or Management Fees

100% of your money goes to work for you right way. No Management or Sales Fees.

Get in touch with us to find out how you can secure a better financial future for you and your loved ones.

Traditional IRA:

Invest in a traditional IRA and defer paying taxes until you make withdrawals in retirement. Why does deferral matter? Simply put, if you think you will be in a lower tax bracket when you retire, your tax savings could be significant when you withdraw the money.

In addition to deferring taxes on current investment income or appreciation, you may be able to deduct all or a portion of your annual contribution, depending on your adjusted gross income.

If you are younger than 70½ in 2018 and have taxable compensation, you may contribute up to the current maximum of $5,500. If you are 50 or older, you can make an additional $1,000 catch-up contribution for a total of $6,500. You also may contribute for a non-working or minimally working spouse.

All earnings from your traditional IRA are automatically reinvested into your account to maximize your total return.

At age 70½, the IRS mandates that you begin taking an annual withdrawal called a required minimum distribution (RMD).

Early withdrawls are subject to ordinary income tax and a 10% penalty if you take a distribution before reaching age 59½.

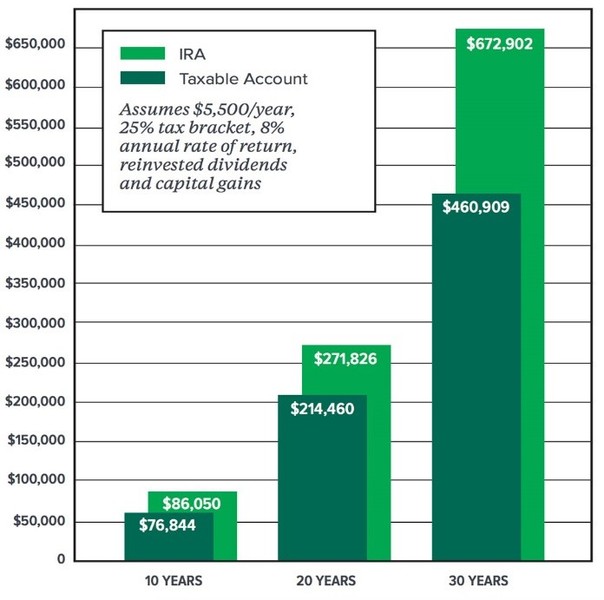

Your IRA’s potential growth is tax deferred until withdrawn and can accumulate substantially faster than identical savings in a taxable account.

******This chart is for illustration purposes only and does not represent the past or future performance of any specific investment. This chart assumes the reinvestment of all earnings and does not take into account any applicable fees, expenses, or possible withdrawals. The chart does not reflect all possible variables that may affect results. This illustration does not reflect the impact of state income taxes. Your situation may be different.

The assumed rate of return is not a guarantee, and investments that pay higher rates of return are generally subject to higher risk and volatility. Please note that lower minimum tax rates on capital gains and dividends would make the investment return for the taxable investment more favorable and thus would reduce the difference in performance between the accounts shown.

Investors should consider their personal investment horizon and income tax bracket, both current and anticipated, when making an investment decision, as these may further impact the comparison.

Roth IRA

What are your tax expectations when you retire? If you think you will be taxed at a higher rate than today, think about saving for retirement with a Roth IRA. You’ll make Roth contributions with money that has already been taxed at today’s potentially lower rate. When you withdraw in retirement, your contributions and any potential growth may be tax free. That’s one big reason to contribute. Other reasons the Roth IRA may be right for you include:

You can contribute to a Roth IRA as long as you or your spouse have taxable income and your modified adjusted gross income is within the Roth limits. For 2018 you may contribute up to the current maximum of $5,500. If you are 50 or older, you can make an additional $1,000 catch-up contribution for a total contribution of $6,500.

- Single, head of household | $120,000-$135,000

- Married filing jointly | $189,000-$199,000

- Married filing separately | $10,000

You can withdraw contributions for any reason at any time without taxes or penalties. However, request a withdrawal before your account is at least five years old or if you are not yet 59½ and the earnings portion may be subject to a 10% penalty (exceptions apply). With a Roth, unlike the traditional IRA, the IRS does not mandate a required minimum distribution at age 70½.

Rollover IRA

What are your tax expectations when you retire? If you think you will be taxed at a higher rate than today, think about saving for retirement with a Roth IRA. You’ll make Roth contributions with money that has already been taxed at today’s potentially lower rate. When you withdraw in retirement, your contributions and any potential growth may be tax free. That’s one big reason to contribute. Other reasons the Roth IRA may be right for you include:

Defer taxes on earnings until withdrawn in retirement.

Avoid current income taxes, including a mandatory 20% income tax withholding and possible 10% excise tax, when you rollover.

Withdraw without tax penalties between ages 59 ½ and 70 ½. After 70 ½, the IRS mandates a required minimum distribution based on your average life expectancy.

Estate Planning

The tax reform also affects how your estate – money and property – is taxed after you die. The law doubled the exemption base for estate transfer taxes from $5.6 million to $11.2 million for individuals. Meaning that the tax is not triggered unless the estate amount exceeds $11.2 million. Because that number is so high, the estate tax does not come into play for most Americans.

In addition, the yearly gift tax limit has increase from $14,000 to $15,000.

Smart Money Management

Smart money management is about more than just accumulating and investing your assets…you also must protect those assets. A serious health problem, a loss of property or even a job change can have a tremendous impact on your financial health. Insurance and annuity products offer a potential way to help safeguard yourself against the risk of the unexpected. This is commonly referred to as risk management, which involves identifying potential lifestyle threats—such as loss of health, property, income, savings or life—and developing appropriate insurance strategies for helping guard against them.

So how do you manage risk?

Start with a comprehensive plan. A comprehensive financial plan that meets your specific objectives and adjusts over time with your changing needs can serve you well for a lifetime.

This information is provided for informational and educational purposes only. This information is not meant to be a complete summary or statement of all available data necessary for making financial or investment decisions and does not constitute a recommendation. It is not to be construed as legal, accounting or tax advice, and is provided as general information to you to assist in understanding the issues discussed. Neither Rainbow Financial Group, nor its Financial Advisors give tax, legal, or accounting advice.

This information is not meant as financial or investment advice pertaining to your personal situation. The selection of appropriate investment, insurance or planning options and/or strategies should be made on an individual basis after consultation with appropriate legal, tax and financial advisors. Nothing contained herein is intended as a solicitation or an offer to buy or sell any product or service mentioned and they may not be suitable for all investors.